Another month, another jobs report, another big winner. Why do I say that?

First, we blew away the published forecast of 170,000 net

new nonfarm payroll positions with 336,000 – almost double. Second, we added 242,000 employed people to

reach 161,669,000. Third, those were

accomplished with private nonfarm payroll wages going up only 6 cents per hour,

to $33.88 – less than inflation.

Much of the rest broke even, including the seasonally

adjusted unemployment rate at 3.8%, the adjusted number of officially jobless

at 6.4 million, the labor force participation rate at 62.8%, and the employment-population

ratio at 60.4%, Others which did change

included the unadjusted unemployment rate, down a seasonal 0.3% to 3.6%, the

number of those jobless for 27 weeks or longer improving 100,000 to 1.2

million, and the count of those working part-time for economic reasons, or

keeping such positions while looking thus far unsuccessfully for full-time ones

100,0000 better at 4.1 million. The only

discouraging number of the ones I consider front-line is the number of people

not wanting a job, up 729,000 to 94,411,000.

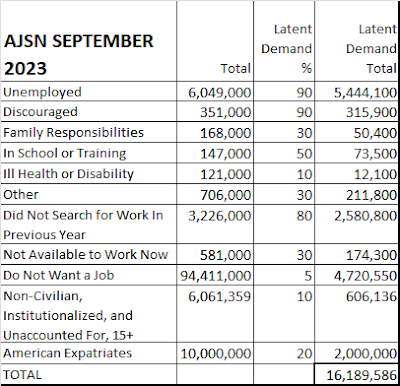

The American Job Shortage Number or AJSN, the metric showing

how many additional positions could be quickly filled if all knew they would be

easy to get, fell a remarkable 621,000 to reach the following:

Five-sixths of the drop was from official unemployment, with

another 138,000 from a lower count of those wanting work but not looking for it

during the previous year. None of the

other factors added or subtracted more than 37,000. With lower unemployment, the share of the AJSN

from official joblessness came in at 33.6%, or 1.9% less than in August.

Compared with a year before, the AJSN gained 223,000, with the

530,000 more contributed from higher unemployment mostly offset by improvements

in the counts of those discouraged, those wanting work but not looking for a

year or more, and non-civilian, institutionalized, and off-the-grid people

comprising about one-eighth less than in September 2022.

Perhaps, with unemployment and workforce participation the

same and more people getting on the shelf, September was not as good as I

thought. But, with so many new jobs

added and once more no reasonably clear movement toward recession – not to

mention noninflationary wage increases – we should take this data as a solid

indication of continued prosperity. As

before, even if it means we are treading water, it’s plenty warm. The turtle, once again, took a good step

forward.

No comments:

Post a Comment