Last month’s Bureau of Labor Statistics Employment Situation Summary was the worst all year. But any thoughts that it would start a trend were dashed this morning.

In November, our economy added 199,000 net new nonfarm payroll

positions. That was not only at the high

end of published predictions – the ones I saw were 150,000, 190,000, and

200,000 – but four times what we needed to cover population increase. All but one of the statistics I report on

improved. Seasonally adjusted and

unadjusted unemployment reached 3.7% and 3.5%, down 0.2% and 0.1%. The number of people with jobs gained 473,000

to 162,149,000, and officially unemployed, seasonally adjusted, dropped 200,000

to 6.3 million. The long-term jobless

out for 27 weeks or longer fell 100,000 to 1.2 million, and those working

part-time for economic reasons, or holding on to shorter-hours propositions

while seeking full-time ones, lost 300,000, getting to 4.0 million. The measures of how common it is for

Americans to be working or counted as technically jobless, the labor force

participation rate and the employment-population ratio, rose 0.1% and a large

0.3% to arrive at 62.8% and 60.8%. Average

hourly private nonfarm payroll wages added 10 cents, more than inflation again,

to $34.10. Those claiming no interest in

work were 9,000 more numerous and numbered 94,839,000.

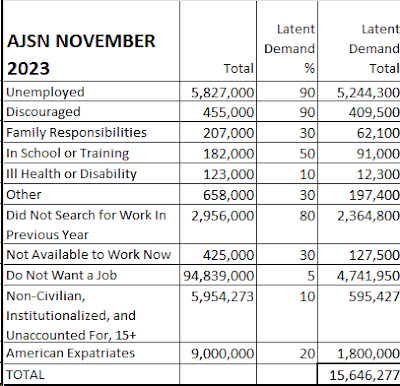

The American Job Shortage Number or AJSN, the metric showing

how many additional positions could be quickly filled if everyone knew they

would be easy to get, lost 488,000 from last month, and ended up at this:

Ninety percent of this month’s change was due to fewer unemployed

and fewer American expatriates, the current State Department estimate of whom

fell one million. The share of the AJSN

from those officially jobless was 33.5%, down 0.5%.

Compared with a year before, the AJSN decreased 154,000,

with the change in expatriates, and in those wanting work but not looking for

it for at least a year, more than offsetting an increase in the jobless

count.

If we draw a two-month line from September to November, we

get average monthly jobs gains of 174,500, adjusted and unadjusted unemployment

each down 0.1%, 100,000 fewer officially jobless, long-term unemployment

unchanged, the employment-population ratio the same but the labor force

participation rate up 0.4%, those working part-time for economic reasons down

100,000, people employed up 480,000, and the hourly wages above up 22 cents. The AJSN fell 543,000. The only minus is the count of those denying

any interest in work, which over the past two months increased 428,000.

All that means we’re still doing superbly. We, in general, more than cancelled out the

previous month’s disappointing showing.

No recession, no shortage of work, wages strong, and inflation at 3%. Overall, these are great times for the

American economy. The turtle took a double-sized

step forward.

No comments:

Post a Comment